RIGOROUS RISK MANAGEMENT

We strongly believe that investment risks must be identified, quantified and monitored.

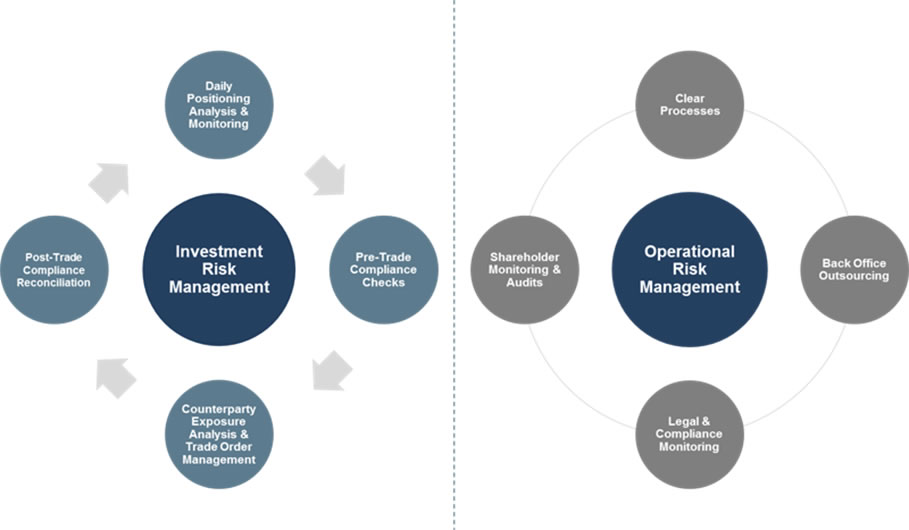

To protect the liquidity and the capital of our investors, strict investment and operational risk management controls have been implemented. We have selected world renowned service providers for each controlling function in each of our Funds.

Our Funds follow a rigorous selection and allocation process. Our proprietary models enable us to measure the associated risks. DELFF portfolios are diversified following strict investment rules and monitored independently by the Chief Risk Officer.

Historical and Stress Testing Analysis are performed to quantify the risk in order to adjust it as required. The Portfolio Construction across all funds is reviewed during the Risk Committees with the goal of achieving optimal risk adjusted returns. The credit quality of the various investments is analysed on an ongoing basis.

DELFF adheres to clear legal and compliance rules. Alongside our Compliance officer, expert compliance specialists oversee our investment process and are inherent to our operational strength.